| shareholders will fire yahoo board | |

|---|---|

| Jun 7, 2008 00:34 | |

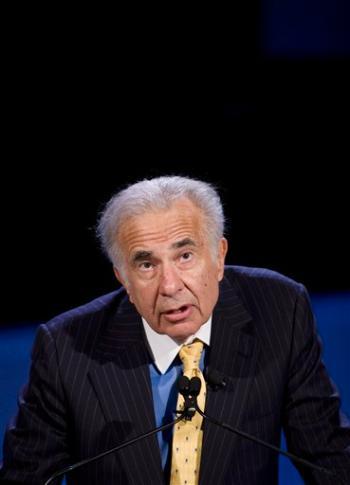

| In this Oct. 11, 2007 file photo, private equity investor Carl Icahn speaks at the World Business Forum in New York. Activist investor Carl Icahn wants Yahoo to tell Microsoft it's willing to be sold for $49.5 billion, about $2 billion above the Microsoft's last offer, Friday, June 6, 2008, for the Internet pioneer. (AP Photo/Mark Lennihan, file) |

| Jun 7, 2008 00:35 | |

| Icahn recommends Yahoo set a $49.5B sale price By MICHAEL LIEDTKE – 8 hours ago SAN FRANCISCO (AP) — Hoping to negotiate a compromise, activist investor Carl Icahn urged Yahoo Inc. to declare it is willing to accept a takeover offer of $49.5 billion — about $2 billion above Microsoft Corp.'s last bid for the Internet pioneer. Icahn recommended the price tag, which works out to $34.375 a share, in a letter he sent Friday to Yahoo Chairman Roy Bostock. It marks the first time that Icahn has publicly indicated what price he has in mind as he tries to force Yahoo's sale before the Sunnyvale-based company's annual meeting on Aug. 1. If a deal isn't done before August, Icahn will try to replace Yahoo's board with a slate of his own directors and then fire company co-founder Jerry Yang as chief executive. Should the mutiny succeed, Icahn said Friday he would then hire a "talented and experienced" CEO in the mold of Google Inc. Chairman Eric Schmidt before trying again to sell Yahoo to Microsoft. Yahoo said it would be "ill-advised" to publicly set a specific sales price. |

| Jun 7, 2008 00:36 | |

| Microsoft declined to comment. Merger talks between the two high-tech powerhouses fell apart May 3 when Microsoft CEO Steve Ballmer withdrew an oral offer of $47.5 billion, or $33 per share, after Yang asked for $37 per share — a price Yahoo's stock hasn't reached since January 2006. By suggesting a sales figure for Yahoo, Icahn clearly hopes to spur Yahoo to seek more expansive discussion with Microsoft, said Peter Falvey, managing director of Revolution Partners, which specializes in high-tech deals. Microsoft has been exploring a partial deal involving Yahoo's search and advertising operations — a concept that has been panned by Icahn, along with many industry analysts who believe the companies need to combine to counter the dominance of Internet search and advertising leader Google Inc. "This (sales figure) keeps the pressure on Yahoo," Falvey said. "It could also act as a sort of fig leaf so they can start talking about a sale again without it seeming like they are crawling back to Microsoft. They can now say to Microsoft, 'Look, we need to have these conversations now.'" Many analysts have been predicting all along that Microsoft and Yahoo would eventually agree to a deal at somewhere between $34 and $35 per share. At least two major Yahoo shareholders, Capital Research Global Investors and Legg Mason, have publicly pushed for a deal in the same price range. While emphasizing it isn't currently interested in buying Yahoo in its entirety, Microsoft also has stressed it hasn't ruled out the possibility of making another bid. |

| Jun 7, 2008 00:36 | |

| For now, Falvey thinks it makes sense for Microsoft to let Icahn agitate for a deal so the software maker doesn't risk alienating the Yahoo workers it hopes to retain. Wall Street's hopes that a friendly deal might still be worked out has helped cushion the blow to Yahoo's stock since the takeover talks unraveled. Yahoo shares gained 8 cents to close at $26.44 Friday amid a sharp downturn in the overall stock market. Icahn recently helped pick up the pieces of fractured sales talks between software makers Oracle Corp. and BEA Systems Inc. After Oracle withdrew a takeover offer of $17 per share when BEA insisted on $21 per share, Icahn helped negotiate a sale at $19.375 per share, or $8.5 billion. Microsoft's withdrawal of its $47.5 billion offer outraged many Yahoo shareholders who believe the company's board allowed Yang's emotions ruin a chance to sell at a price far above Yahoo's market value before Microsoft made its bid Jan. 31. At $33 per share, Yahoo shareholders would have received a 72 percent premium, based on the company's $19.18 stock price at the time of Microsoft's initial offer. Yang maintains Yahoo is poised to bounce back from a financial malaise that caused the company's stock to crumble. He has promised his business strategy will generate more online ad sales and increase Yahoo's net revenue by at least 25 percent in 2009 and 2010. Yahoo's net revenue has recently been rising about 12 percent a year, far behind Google's first-quarter pace of 46 percent. Besides imploring Yahoo to set a sales price, Icahn on Friday reiterated an earlier demand for Yahoo to eliminate an employee severance plan that could trigger $2.4 billion in additional payments if Microsoft bought the company at $35 per share. The estimated costs of the plan, adopted 12 days after Microsoft's initial bid, surfaced earlier this week when a Delaware court unsealed documents in a Yahoo shareholder lawsuit alleging the company improperly tried to avoid a takeover. Yahoo once again defended the severance program as a good thing for shareholders, saying it will help retain top workers while the company's fate remains in limbo. Icahn also dropped one of his candidates for Yahoo's board because the company now has only nine directors instead of the 10 that were in place when the investor first mounted his challenge. With the change, Keith Meister — one of Icahn's business associates — is no longer seeking a spot on Yahoo's board. |

| Jun 7, 2008 07:48 | |

GUEST22086  | Geez, cutting and pasting entire articles...looks like my university writing class. |

| Jun 8, 2008 21:13 | |

| think about it, buddy: mock operation in stock mkt just for me-the poor gal. topic on this deal lasts for some time. if you were in with belief that MS would make it, what's the margin you get today or this Auguest with the newly suggested bid price. but this is rich people world with money getting much more opportunities. We-poor people just do mock stuff for fun. chance is there but most people are risk averse. hehe...just for fun. who knows what's gonna happen on this deal, let wait and see...info. is one thing- IT era, everybody is equal in data integrety, transparency and instant -- i think in stock mkt, fundamental analyst have more opp. than technical analyst in this case... |

| Jun 13, 2008 04:04 | |

| Coolsprings, the news reports that Yahoo! has announced that they have stopped negociating with MS because MS has refused to offer 47.5 billion dollars to buy Yahoo!. Impacted by this, Yahoo!'s shares slumped 10.6 percent on June 12nd. |

Post a Reply to: shareholders will fire yahoo board

Copyright © 1998-2026 All rights reserved.

Copyright © 1998-2026 All rights reserved.