| David Barboza: To See a Stock Market Bubble Bursting, Look at Shanghai | |

|---|---|

| Apr 3, 2008 03:53 | |

| 2007 saw a stock buying frenzy in China. Over all, the Chinese stock market experienced a bullish market in the year of 2007. However, at the turn of the year, the bubble bursted. Small investors and speculators were stuck in the gloomy market. David Barboza, a correspondent for The New York Times based in Shanghai, China, He writes for the Business section. He covered the Enron scandal for The Times. Having been in Shanghai since 2004, David Barboza has a good knowledge of Shanghai. After I read his report about the stock market in Shanghai, personally, I think his report mirrors the real state of China's stock market. What Went Up Just Came Down  |

| Apr 3, 2008 03:55 | |

| To See a Stock Market Bubble Bursting, Look at Shanghai Many Chinese investors, like Guan Ling, left, and his business partner spend hours in front of computer terminals at brokerage houses, keeping track of their investments. By DAVID BARBOZA Published: April 2, 2008  |

| Apr 3, 2008 03:56 | |

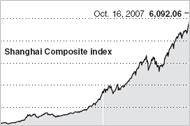

| SHANGHAI — A year ago, investors like Guan Ling were ebullient. Chinese share prices had climbed over 500 percent in the span of two years, setting off a nationwide stock buying frenzy. What Went Up Just Came Down When experts periodically warned about the possibility of a bubble, prices would dip temporarily then soar even higher, breaking records and inciting another mad dash to snap up equities. “The market was going wild,” says Mr. Guan, 49, who a few years ago closed his real estate company to invest in stocks full time. “Everybody was talking about how much they had earned, how much more they would invest, and which stocks had jumped 20 times, or even 30 times.” That was last year. The Shanghai composite index has plunged 45 percent from its high, reached last October. The first quarter of this year, which ended Monday with a huge sell-off, was the worst ever for the market. Suddenly, millions of small investors who were crowding into brokerage houses, spending the entire day there playing cards, trading stocks, eating noodles and cheering on the markets with other day traders and retirees, are feeling depressed and angry. "These days my family quarrels a lot," says Zhang Liying, 55, a retired hotel waitress who with her husband invested all their savings in the stock market. “My husband asked me to sell; I wanted to hold for a while. Now my husband condemns me as so stupid that we lost our family’s savings.” Si Dansu, 68, and a retired engineer, is even more distraught, but she blames the government. “I devoted my whole life to the country. I went to the countryside after graduation, and worked as an engineer in a Shanghai factory until retirement. I invested almost all my savings and retirement fund in the market 10 years ago. But now I’m totally penniless. All my stocks went down.” Other parts of Asia are as bad, or worse. In India, stock prices have plunged 31 percent in Mumbai; they are off 31 percent in Japan and a whopping 53 percent in Vietnam, another booming economy. Angry investors have burned a securities regulator in effigy in Mumbai, and some are in tears in Ho Chi Minh City, Vietnam. |

| Apr 3, 2008 03:58 | |

| “Some of them have cried,” says Nguyen Quang Tri, 74, a retired cement company manager who was visiting a Ho Chi Minh City brokerage house this week. “I have my own equity, but most of the people here borrowed money from the bank.” The market mayhem began after concerns grew late last year about inflation at home and an American financial crisis. Now, even though China’s economy is growing at its fastest pace in over a decade, stock prices have fallen back to earth, crushing small investors on the way down. Few experts say the stock plunge is a major threat to growth in the real economy here. But there are worries that a prolonged downturn could reverberate through China’s financial markets — especially since a large number of corporations had aggressively shifted money, sometimes secretly, to play the market. By some estimates, 15 to 20 percent of the profits reported last year by publicly listed companies in Shanghai that are not involved in banking or finance (which usually invest in stocks) came from stock trading gains. Companies with primary businesses like selling electricity, or even sports jackets, were moonlighting by trading stocks, hoping to bolster their earnings. “Companies had a lot of excess cash,” said Jing Ulrich, a market analyst at JPMorgan in Hong Kong. “And a lot of that cash did leak into the stock market.” But the big companies were following the small investor. JPMorgan estimates that 150 million people in China were invested in the Chinese stock market as of the end of last year. That may still be a small slice of China’s 1.3 billion people, but it is a huge new constituency, and it has led to the birth of both a new source of potential popular discontent and a new lifestyle: the diehard investor. Chen Donghao is one convert. A 22-year-old recent college graduate, he is now a fixture at a Shanghai brokerage house. In April 2006, when he was still a student majoring in art design, his family gave him about $70,000 to invest in the stock market. It was an ideal time to get in “When I started the stock market was around 1,700,” he says, noting that today, despite the drop, the Shanghai composite index is still up at about 3,400. “I made a lot of money. So since the beginning of this year I decided to open a restaurant. I’d like to open a chain of famous restaurants in Shanghai.” What Went Up Just Came Down Shopkeepers, real estate brokers, even maids and watermelon hawkers are said to have become day traders. A new version of the national anthem made its way around the country last year, beginning, “Arise! Ye who haven’t opened an account! Pour your gold and silver into the hot market!” |

| Apr 3, 2008 04:00 | |

| The anthem went on: “The Chinese nation faces its craziest time. The passionate roar of our peoples will be heard!” People responded. Here in Shanghai, brokerage houses with giant electronic screens started to draw huge crowds, including many retirees who were content to spend the entire day transfixed by the sight of rising prices. In some brokerage houses, entire floors are divided into small and midsize rooms that investors camp out in, from opening to closing bell, with their lunch bags, knitting gear, playing cards and newspapers to help them feel at home. Only now, many investors cannot bear to look at their screens. “I’m getting out of the game,” said Yuan Yuan, 23, a researcher at a fund company in Shenzhen who also invests on his own. “The game is over. Big institutions pulled out first, only leaving the small investors.” In China, the government fears that angry investors can be a social problem. And so while the state-run media report on the ups and downs of the market, and even warn investors of the risks and pitfalls of investing, the press does not usually report on investors’ anger. “Actually there are a lot of complaints, but the Chinese media can’t report this,” says Mr. Guan, the former real estate company owner. Now, in the brokerage house corridors — corridors of pain — one can hear complaints about all the market flaws: the government doesn’t regulate the stock market and it participates in it by allowing mostly big state-owned companies to go public. There are also complaints about insider trading, stock manipulation, and big investors with government connections, pumping and dumping stocks on small investors. But in China, experts say, the small investor also tends to be a speculator, a gambler, and that may be why the market is so volatile, and so unforgiving. “You know Warren Buffett?” says Chen Weihua, a 69-year-old retired engineer who once worked in Egypt. “He’s a master. He has a theory to hold stocks for a long time. But this theory doesn’t work in China. Look at Ping An.” Ping An is a state-owned insurance company that went public last year, with shares that soared to $144 a share in Shanghai, then sank. Today, it is trading at about $50 a share, despite strong profit growth. This was not the way it was supposed to end. Many investors had been betting that Beijing would not allow the stock market to crash before the Olympic Games come to Beijing in August. After the Games, the powerful rumor went, everyone would sell, leading to a steep market plunge. And if anything serious happened before the Olympics, the government would certainly do something to prop up the market. They are still waiting. “It’s a deformed market, an unhealthy market,” Mr. Guan says. “We’ve always had long bear markets and short bull markets.” “Look,” he said, “it took two years to go from 1,000 to 6,000 but two months to go from 6,000 to 3,500.” |

| Apr 3, 2008 13:33 | |

| "There are lies, damned lies, and statistics". A well known quote attributed to many different people. Leonardo, that graph is such an example statistics. It uses a technique popular with politicians and neewspapers. What is the baseline and what is the vertical and horizontal scales. the graph has been drawn as if it is rising from just above zero and thus a massive growth.. But if the base line is 6,000, and each hoizontal increment is 20 units, (which gives the top figure of about 6092), the rise is rather less dramatic at about 1.5% !!. Is the timespan, the horizontal axis, a year, a month or what... it makes quite a bit of difference how long that 1.5% is spread over! |

| Apr 3, 2008 17:02 | |

| For the majority of people it's like being an amateur player and competing against a professional. Buy low and sell high (that's an overstated phrase) There's a lot of "insider trading" not being reported that is a disadvantage to the individual investor. (U.S. stock market anyway ) Corporate finances and financial statements can be questionable( to create a higher stock value) All in all it amounts to "BUYER BEWARE" |

| Apr 3, 2008 19:39 | |

| Gary, you've another title - external auditor, hope you could catch 2nd Enron. |

| Apr 4, 2008 00:52 | |

| Am going to make a comment about the Savings and Loan debacle from the late 1980's in the States which was a result of "deregulation" and the sub prime and mortgage mess today for basically the same reason. It appears that we go through these cycles approximately every 20 years and the public seems to fall asleep only to be awakened by these events, after the facts, when it's too late. Well, of course, there was a tech bubble and Enron plus some some other energy and communications companies that went bust due to lack of both external and internal controls in the late 1990's. I know this doesn't have anything to do with China's stock market but the word "Enron" set me off. Thank you DRGARYAQUACK |

| Apr 4, 2008 20:48 | |

| ((internal controls )) The saying goes: who cares, it's not my business, it's shareholders' business Do whale-like eating when you have access to power (management is the agent of stake holders) messy internal controls and nuts will destroy small business in no time, that's why small firm employment policy is much more picky especially emphasizing on personal moral level and comprehensive skills. |

| Apr 5, 2008 22:49 | |

| As Chinese stock market is growing quickly, many speculators intend to make profits in the market. On the other hand, the relevant regulations and laws haven't been worked out to deal with the speculation in the market. I am sure that there are some manipulators in the dark to are manipulating the market to make money. Only these small investors in the market suffter from the slump in the stock market. |

Page 1 of 2 < Previous Next > Page:

Post a Reply to: David Barboza: To See a Stock Market Bubble Bursting, Look at Shanghai

Copyright © 1998-2026 All rights reserved.

Copyright © 1998-2026 All rights reserved.